All of my % would be a larger chunk otherwise since tax would be taken out of the pie.Ĭharitable Gifts 0% I'm a selfish terrible person, sorry!.

#Dave ramsey budget breakdown plus#

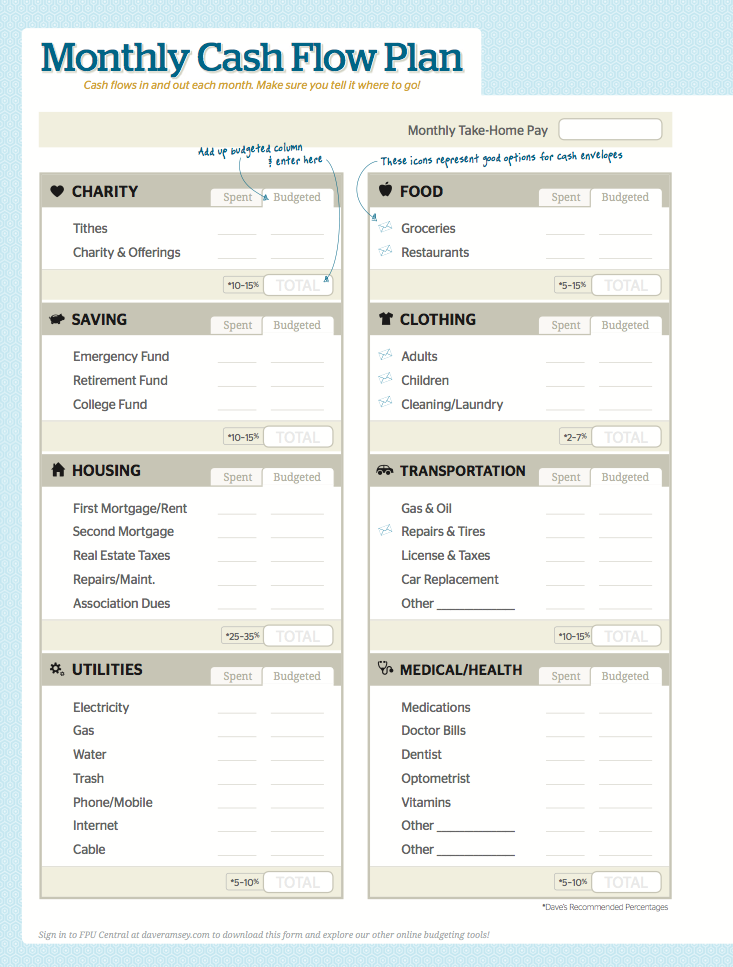

This is out of GROSS income of $5000 as its easier for me to take into consideration the retirement %'s plus I consider it part of the budget and tax/benefit stuff takes a huge chunk out anyways. Maybe it's because I'm not a fashionista, but it's mind boggling how much some people spend on clothes - I'm not sure I could spend the 7% upper limit if I tried! Is it just chasing after the latest fashions, or is it people buying shitty clothes that wear out in a year or two? I only go clothes shopping once or twice a year & generally only buy a few things. I almost never eat out, try to cook from scratch, and eat leftovers, so I save a shitload on food.ĭebt is me aggressively repaying my student loans - no credit card debt, and I plan on keeping it that way. I do get rid of most of my old clothes and whatnot at goodwill, so that makes me feel like less of a scrooge.) Savings 16% (includes both e-fund and retirement savings)Ĭharity <1% (I'll throw $50 at one once a year. Health 3% (mostly saving for regular dentist/eye doctor visit copays) We have transitioned to Dave Ramsey's envelope system and pay cash for almost everything. My husband and I have a budget notebook that has every single expense and category written out so we know where every $ is going. I'm not sure if you are married or have a partner but it is important to be on the same page as them. Savings 11% (This includes contributions to 401K and Pension as well)Ĭlothing 2% (Would be less if I didn't have a growing child that needs new clothes all of the time.

If you have any debt focus on paying that off first. Your first few months will find area's you need to adjust and after about 3-4 months you should have a pretty good flow of where your money goes. You have already working on completing your first step and that is creating your budget. It's always interesting to compare to what it "should" be. I haven't put my budget in %'s for quite awhile. Now all I do is maintain my budget and review it quarterly to see if I can decrease the price. I did that when I initially started and the only 2 items that didn't change was my rent and my electric bill. Then research online for ways to reduce all of your bills. Review all of them and ask yourself if you're actually using the item, how happy you are with the item, if you would be better off canceling it. What you need to do, is create an itemized list of all of your expenses. Some of us have high rent because we live in a city, some of us have low utilities because our landlord pays for our heat and maybe even electric, and some of us don't own cars. Asking us for our budgets won't help you with your budget because we are all dealing with different things. The secret to budgeting is figuring out what works for you through trail and error. But my utilities/transportation are less. ex: my rent is over Dave Ramsays estimate. Also, you have to realise that we are all in different positions, our expenses vary depending on our location as well as personal responsibilities. As long as you realize that a motivator is bound to make more mistakes than an advisor, his game makes sense.ģ5% savings (school/retirement/condo etc.)ħ% utilities (gym, phone, electric, internet, transportation)ĭonating more than you're saving is insane. People need to realize that the reason why he has so many followers is because he is a motivator rather than a personal advisor. I agree that he is overly optimistic and his math is off.but he is selling encouragement, not financial planning. Then, after settled, continue to give.Ī lot of people in this thread seem to have only heard of DR's stuff second hand and not heard what he actually has to say at all. He has said on multiple occasion that it is reasonable to stop giving for a whole in order to get yourself in order and bring yourself to a higher income. It is more about the giving than tracking the numbers to be sure they match.Īnd finally, he has addressed the 10% in terms of a "rule". He has also said that, while he pushes for 10%, less than 10% is still a good thing. He advocates donating time if you do not donate money. He has said that he understands in people stop giving during the debt time period. People are down voting you, but you are correct in a way. Here, please treat others with respect, stay on-topic, and avoid self-promotion.Īlways do your own research before acting on any information or advice that you read on Reddit.

#Dave ramsey budget breakdown how to#

Get your financial house in order, learn how to better manage your money, and invest for your future.

Banking Megathread: FDIC, NCUA, and your cash.Private communication is not safe on Reddit. Scam alert: Ignore any private messages or chat requests.

0 kommentar(er)

0 kommentar(er)